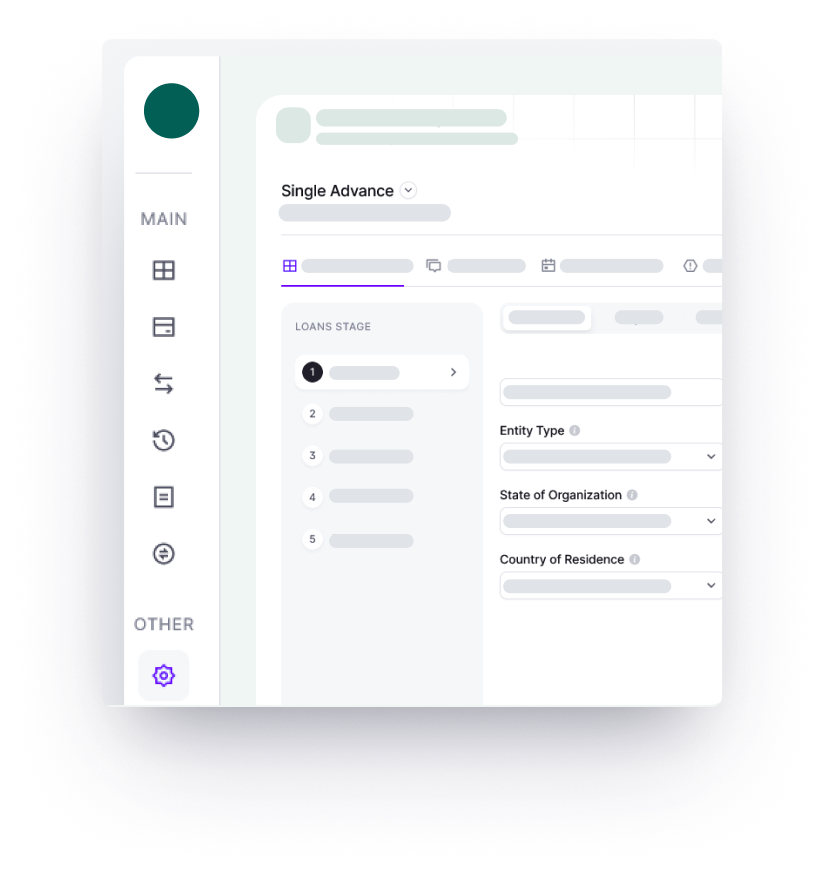

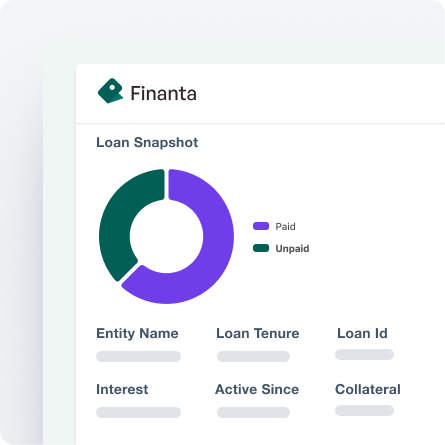

Finanta’s Commercial Loan Origination System and Underwriting

Elevate your commercial loan processing and underwriting for the American market with Finanta’s scalable and secure LOS and Underwriting module. A customizable, scalable, and collaborative platform to truly transform your loan origination process