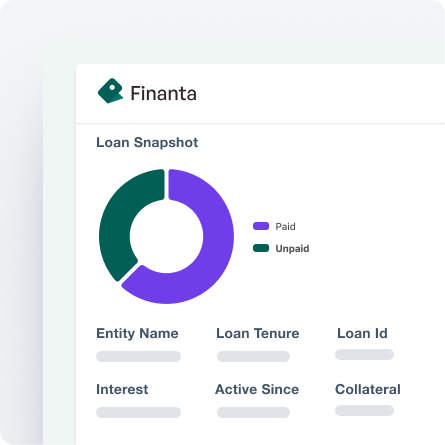

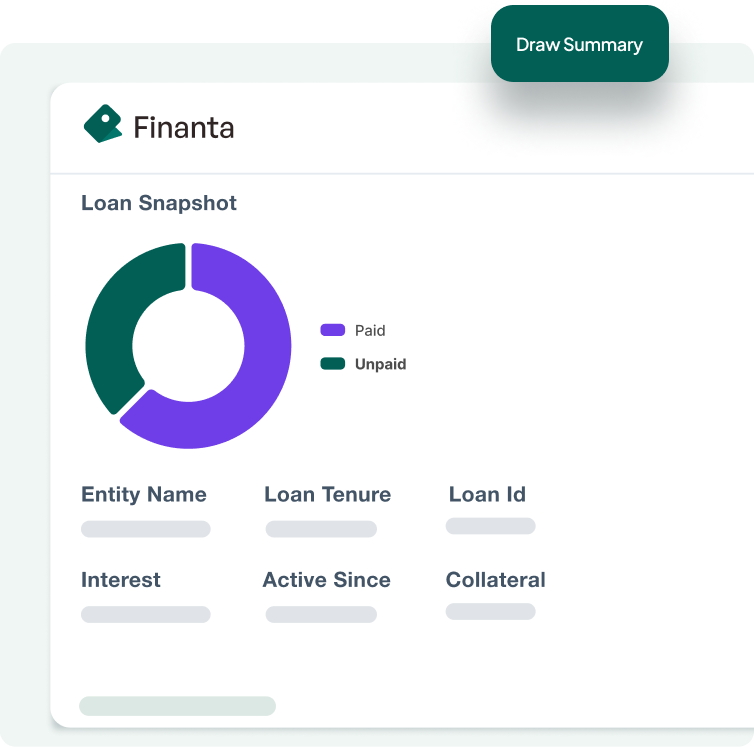

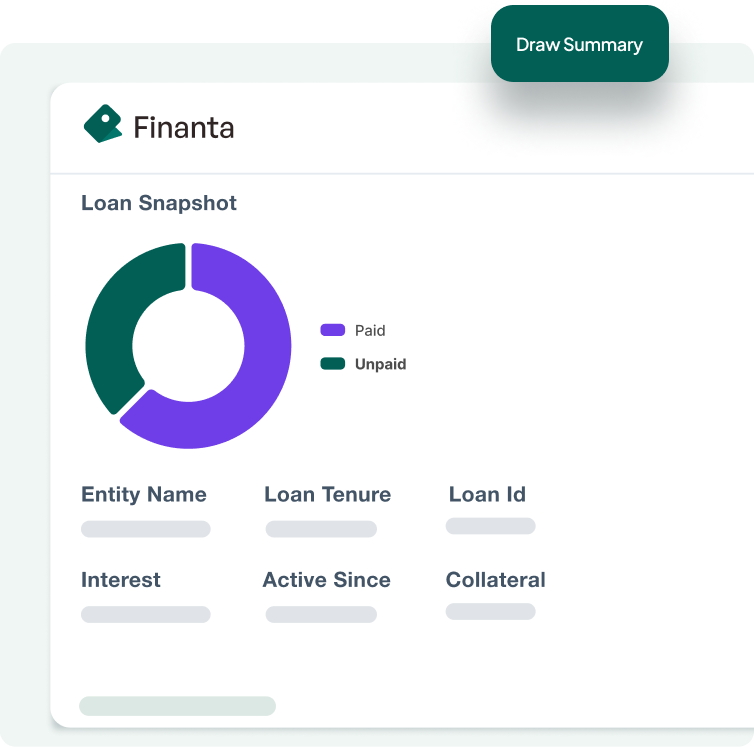

Finanta’s Advanced Loan Servicing Solution

Maximize efficiency and customer satisfaction in your loan portfolio with Finanta's innovative Loan Servicing tools, designed for the modern lender.

Maximize efficiency and customer satisfaction in your loan portfolio with Finanta's innovative Loan Servicing tools, designed for the modern lender.

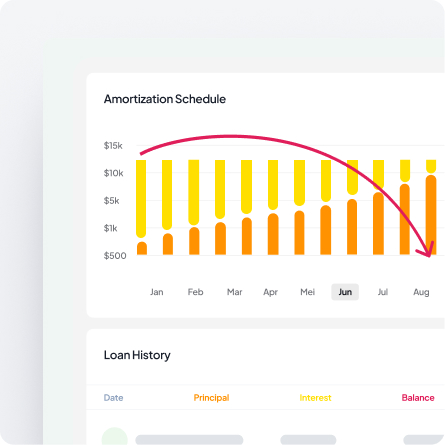

Finanta revolutionizes the commercial lending cycle with a focus on efficiency, adaptability, and client success. Our Loan Servicing module streamlines post-origination management, ensuring consistent lender-borrower engagement and the agility to meet evolving financial demands with robust reliability.

Finanta’s Digital Credit Presentation feature comes equipped with standardized templates that streamline the creation of compelling loan narratives, ensuring consistency and clarity in every credit presentation.

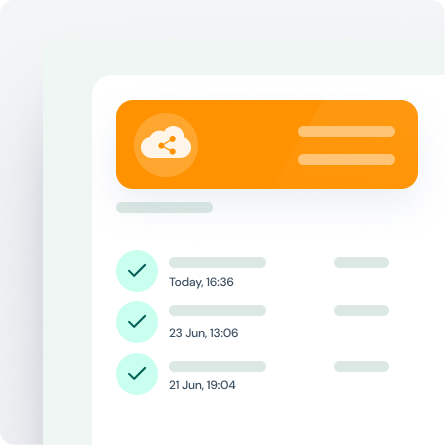

With Finanta, borrowers receive timely reminders and statements, fostering a proactive communication ecosystem that upholds payment discipline and nurtures lender-borrower rapport.

Our system dynamically responds to change, managing loan modifications and renewals with the finesse required for both lender benefit and borrower satisfaction.

Finanta's platform offers a comprehensive suite of tools for detailed monitoring and reporting on loan performance, ensuring lenders have a full spectrum view of their portfolio's health.

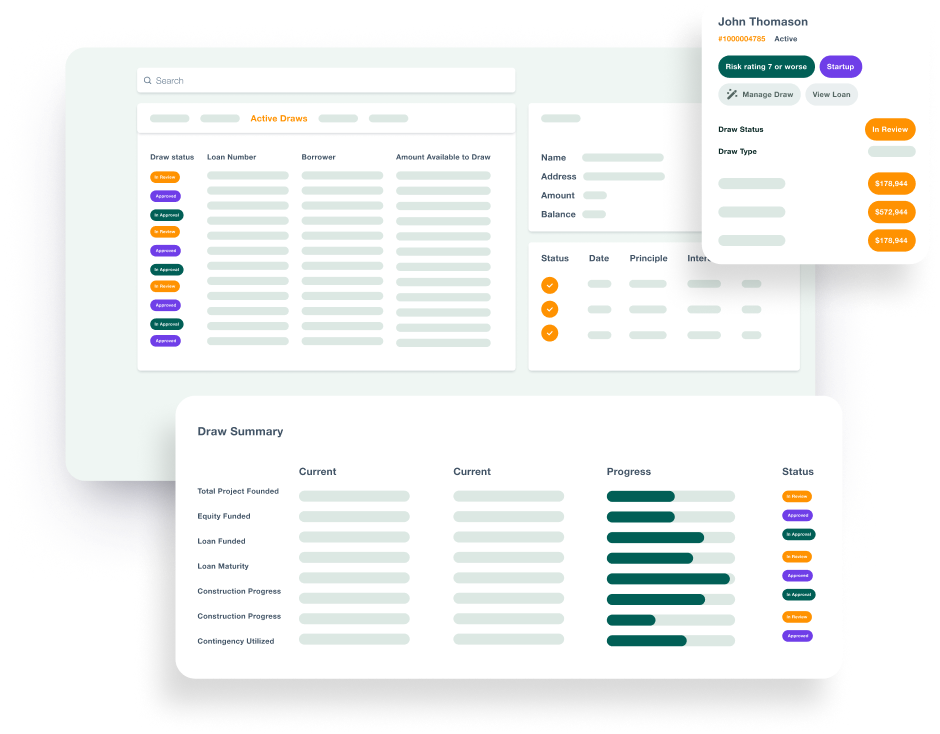

Dynamic Draw Schedules & Request Management

Dynamic Draw Schedules & Request Management

Flexibility in Loan Management

Flexibility in Loan Management

Exception Handling with Finesse

Exception Handling with Finesse

Borrower Empowerment

Borrower Empowerment

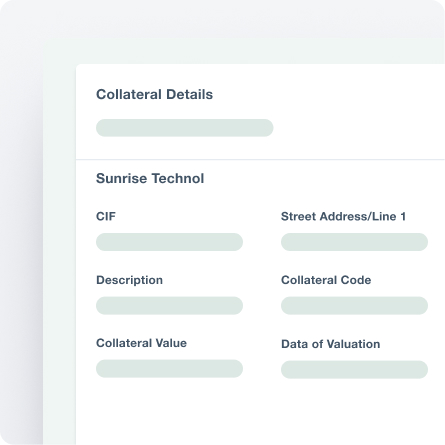

Finanta's Loan Servicing module reimagines borrower interactions, creating a truly digital, 360-degree experience that places customer satisfaction at the heart of every transaction. Our comprehensive customer management system not only streamlines loan disbursement but also crafts a journey of transparency, responsiveness, and personalized service.

Finanta's Loan Servicing module is designed not just to meet but to exceed the evolving demands of commercial lending. From initial disbursement to the final payment, and through every modification in between, Finanta ensures that every step is taken with precision, foresight, and the ultimate goal of fostering lasting customer relationships and financial success.