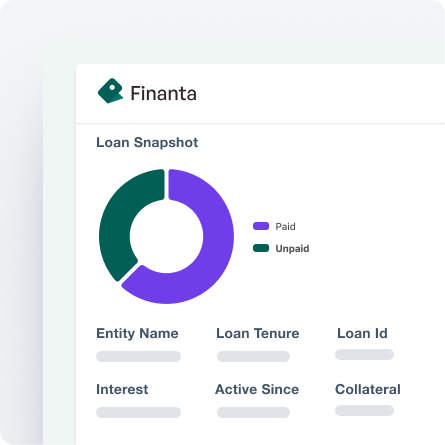

Ensuring Regulatory Compliance at Every Step

Navigate the complexities of commercial lending with confidence. Finanta's Compliance Checks module delivers the robust oversight your business demands.

Navigate the complexities of commercial lending with confidence. Finanta's Compliance Checks module delivers the robust oversight your business demands.

In the high-stakes world of commercial lending, regulatory compliance is not just a requirement—it's the cornerstone of trust and integrity. Finanta's Regulatory Compliance Check module is engineered to provide comprehensive risk management and compliance solutions that integrate seamlessly with third-party services for an in-depth credit and risk scoring, including KYC, OFAC, and document verification.

Transform Your Lending Processes Advanced Risk Analysis

Advanced Risk Analysis

AML Compliant and

Full Risk Report

AML Compliant and

Full Risk Report

Company

Documentation and

Continuous Update

Company

Documentation and

Continuous Update

LEI and Tax ID

Verification

LEI and Tax ID

Verification

Detailed

Investigation and

Full Audit Trail

Detailed

Investigation and

Full Audit Trail

By integrating Finanta's Compliance Checks into your lending operations, you take control of regulatory risks and ensure compliance with ease and efficiency. Our platform is a critical ally in navigating the intricate compliance landscape of commercial lending, providing the tools you need to focus on growth and customer service.