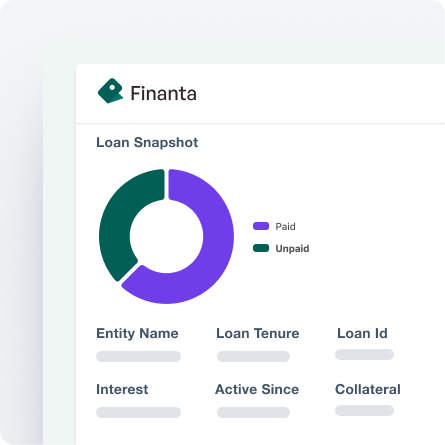

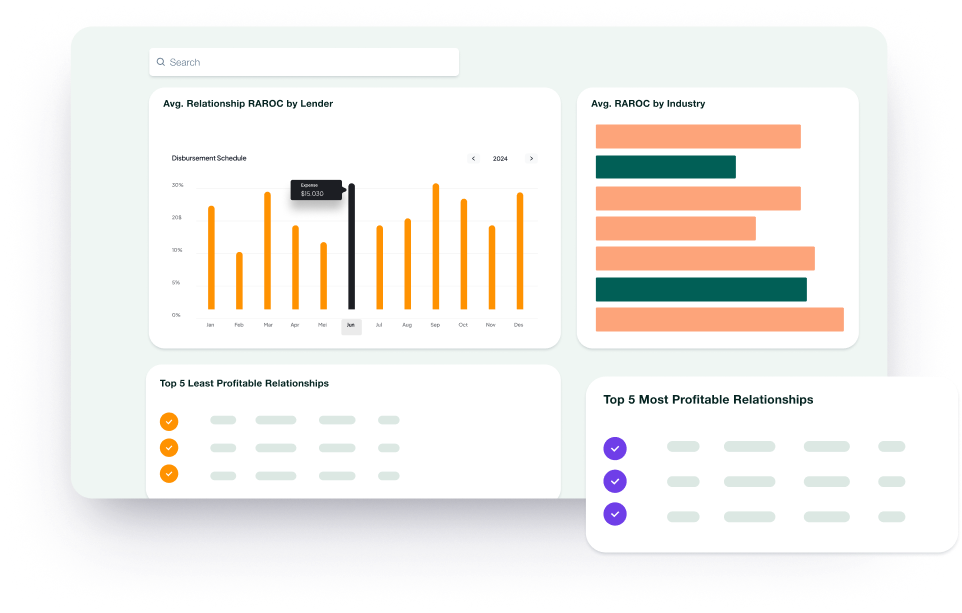

Intuitive Loan Portfolio Management

Maximize performance and minimize risk with Finanta's comprehensive Loan Portfolio Management—where insight meets foresight in commercial lending.

Maximize performance and minimize risk with Finanta's comprehensive Loan Portfolio Management—where insight meets foresight in commercial lending.

Finanta's Loan Portfolio Management streamlines the complexity of commercial lending. It offers lenders a comprehensive solution for strategic portfolio optimization, enabling detailed analysis, efficient risk management, and performance tracking across all loans.

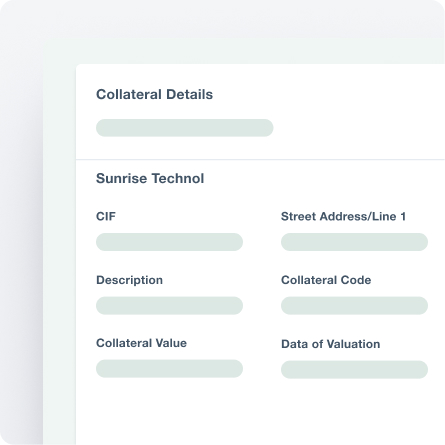

Obtain a 360-degree perspective of the relationship with each borrower, with detailed demographic, financial, and risk data, all contributing to a more informed lending strategy.

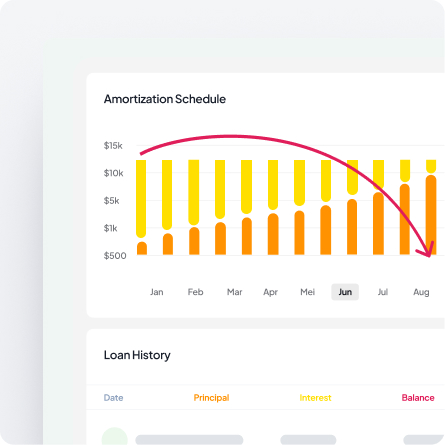

Monitor delinquency trends, charge-off rates, and concentration risk while maintaining regulatory compliance with automated exception reporting and aging analysis across all lending products

Streamline lending operations with funnel analysis, cycle time tracking, conversion rate monitoring, and SLA performance metrics to maximize efficiency from application to funding.

deep insights into portfolio balance, utilization rates, LTV ratios, and product diversification with trend analysis and concentration monitoring across across geographies and lending segments.

Operational Analytics

Operational Analytics

Portfolio Profitability Analytics

Portfolio Profitability Analytics

Real-Time Loan Performance Monitoring

Real-Time Loan Performance Monitoring

Reporting

Intelligence

Reporting

Intelligence

Cross-Selling and Customer Retention Strategies

Cross-Selling and Customer Retention Strategies

Finanta's Loan Portfolio Management streamlines commercial lending, offering tools for growth, risk management, and enhanced borrower engagement—unlocking new possibilities in portfolio optimization.