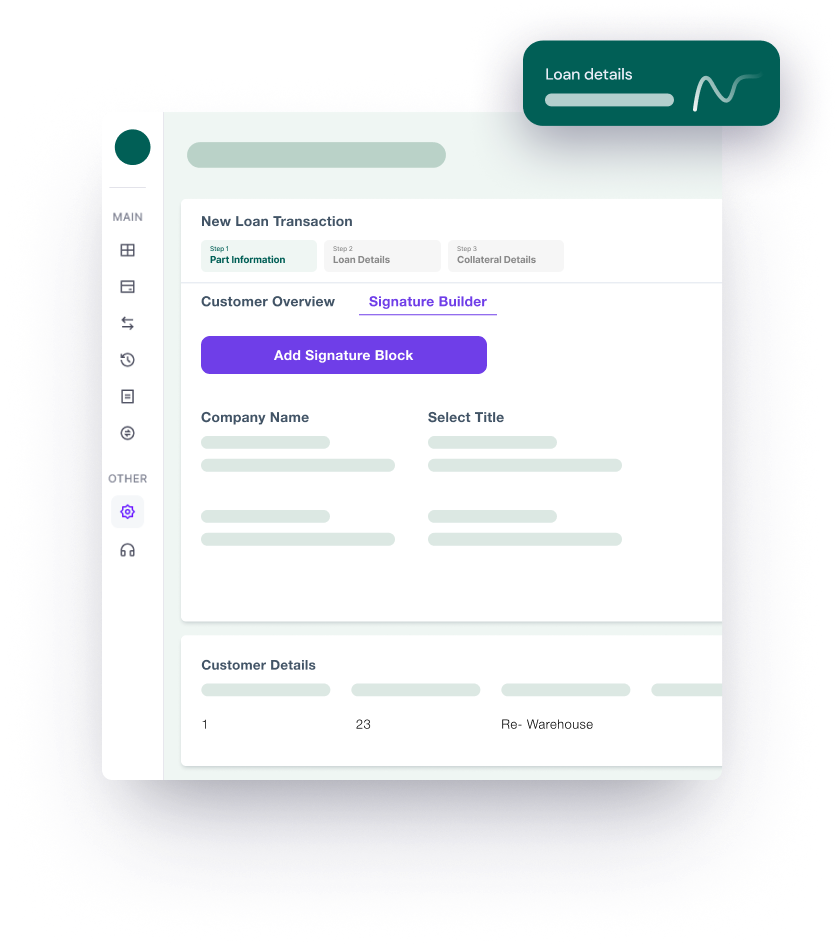

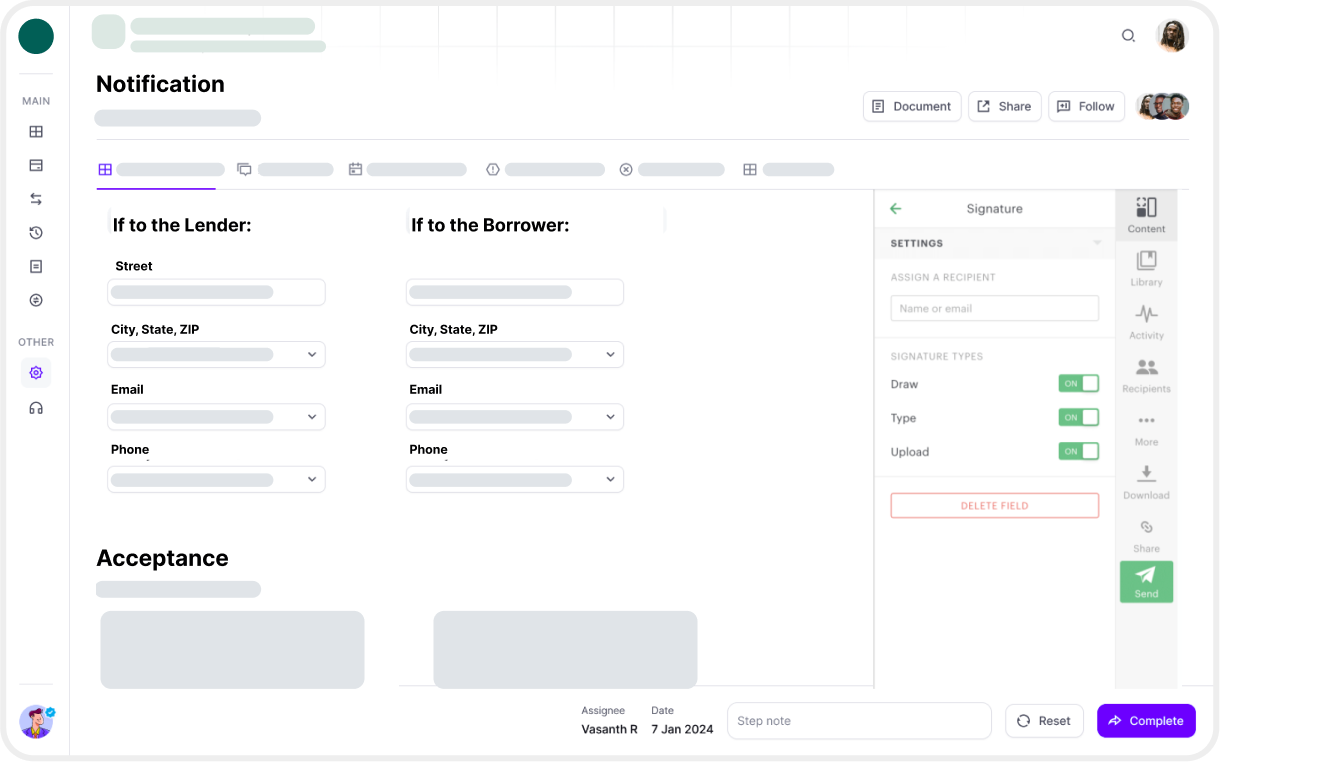

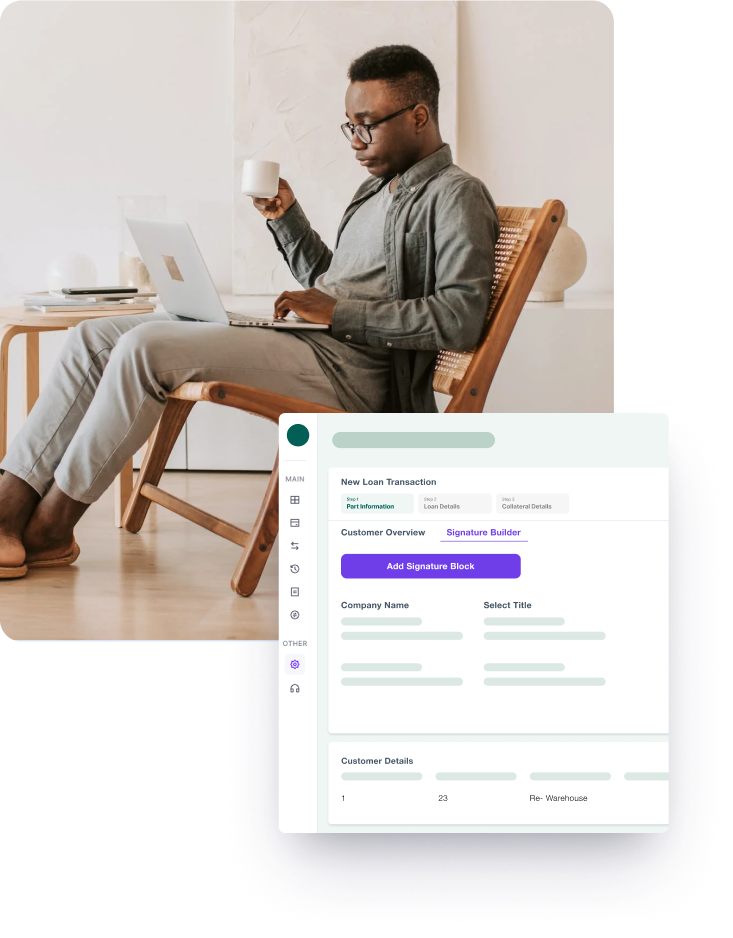

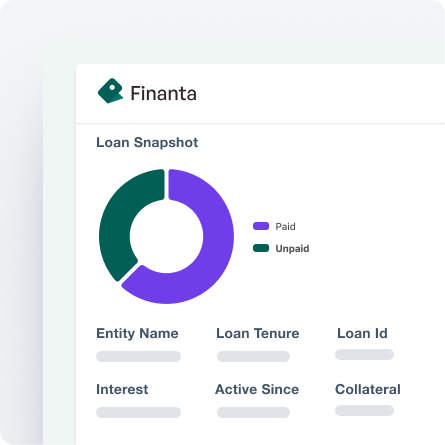

Transform Your Credit Decisions with Digital Precision

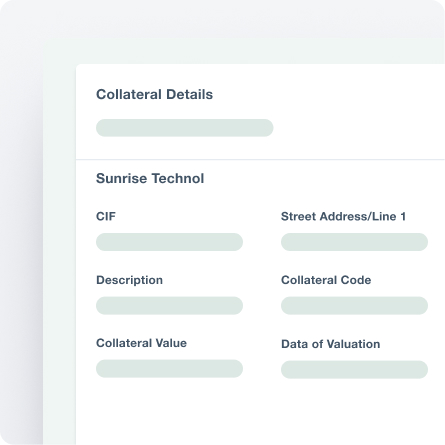

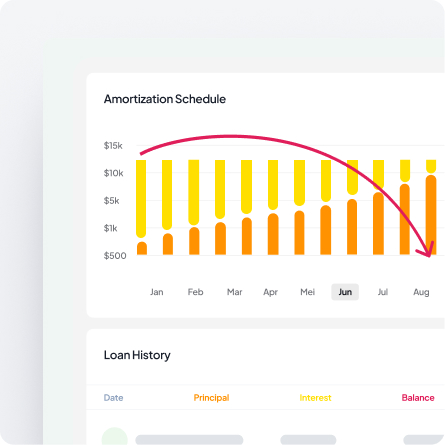

Unlock the power of speed and security in your commercial lending decisions with Finanta's Digital Credit Presentation. Experience a leap in operational efficiency and smarter lending models, all within our comprehensive Finanta platform.