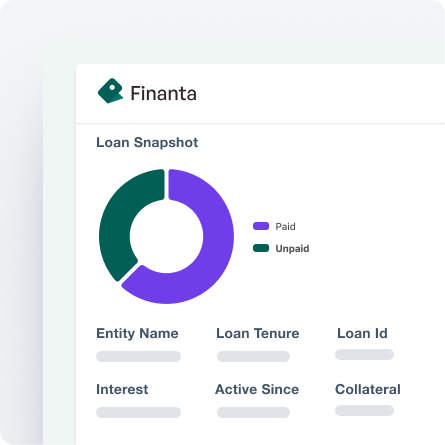

Intuitive Loan Portfolio Management

Maximize performance and minimize risk with Finanta's comprehensive Loan Portfolio Management—where insight meets foresight in commercial lending.

Maximize performance and minimize risk with Finanta's comprehensive Loan Portfolio Management—where insight meets foresight in commercial lending.

Finanta's Loan Portfolio Management tool streamlines the complexity of commercial lending. It offers lenders a comprehensive solution for strategic portfolio optimization, enabling detailed analysis, efficient risk management, and performance enhancement across all loans.

Obtain a 360-degree perspective of each borrower, with detailed demographic, financial, and relationship data, all contributing to a more informed lending strategy.

With robust risk analysis and credit scoring capabilities, Finanta ensures that you're equipped to identify, assess, and mitigate potential risks effectively.

Navigate through financial complexities with ease, leveraging Finanta's tools for an in-depth understanding of balance sheets, P&L, ratios, and more.

Stay aligned with the ever-changing regulatory landscape, ensuring your portfolio adheres to the latest compliance standards.

Advanced Risk

Analysis

Advanced Risk

Analysis

Credit Scoring &

Analysis

Credit Scoring &

Analysis

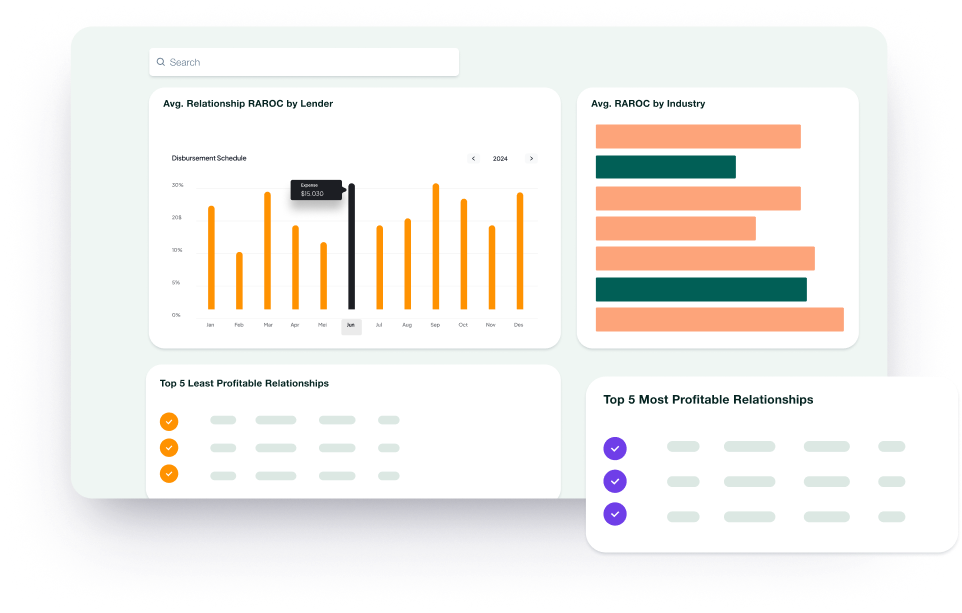

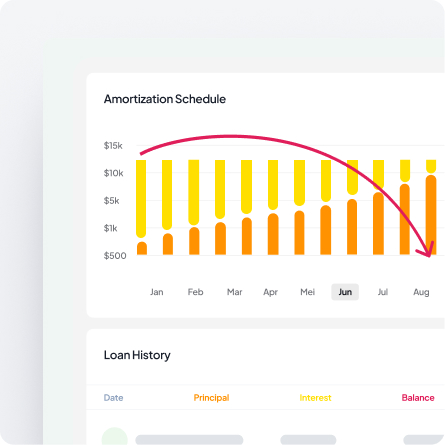

Real-Time Loan Performance Monitoring

Real-Time Loan Performance Monitoring

Reporting

Intelligence

Reporting

Intelligence

Cross-Selling and Customer Retention Strategies

Cross-Selling and Customer Retention Strategies

Finanta's Loan Portfolio Management streamlines commercial lending, offering tools for growth, risk management, and enhanced borrower engagement—unlocking new possibilities in portfolio optimization.

In a world increasingly driven by technology, data, and digital marketing...

The development and application of advanced credit decisioning models are integral...