Ensuring Regulatory Compliance at Every Step

Navigate the complexities of commercial lending with confidence. Finanta's Compliance Checks module delivers the robust oversight your business demands.

Navigate the complexities of commercial lending with confidence. Finanta's Compliance Checks module delivers the robust oversight your business demands.

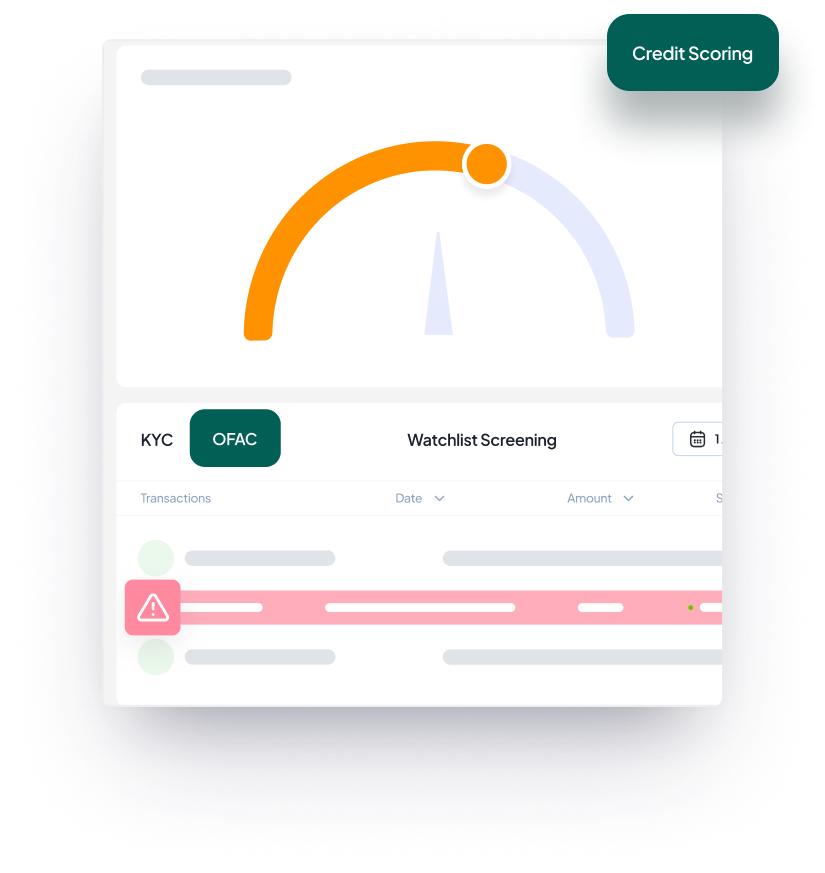

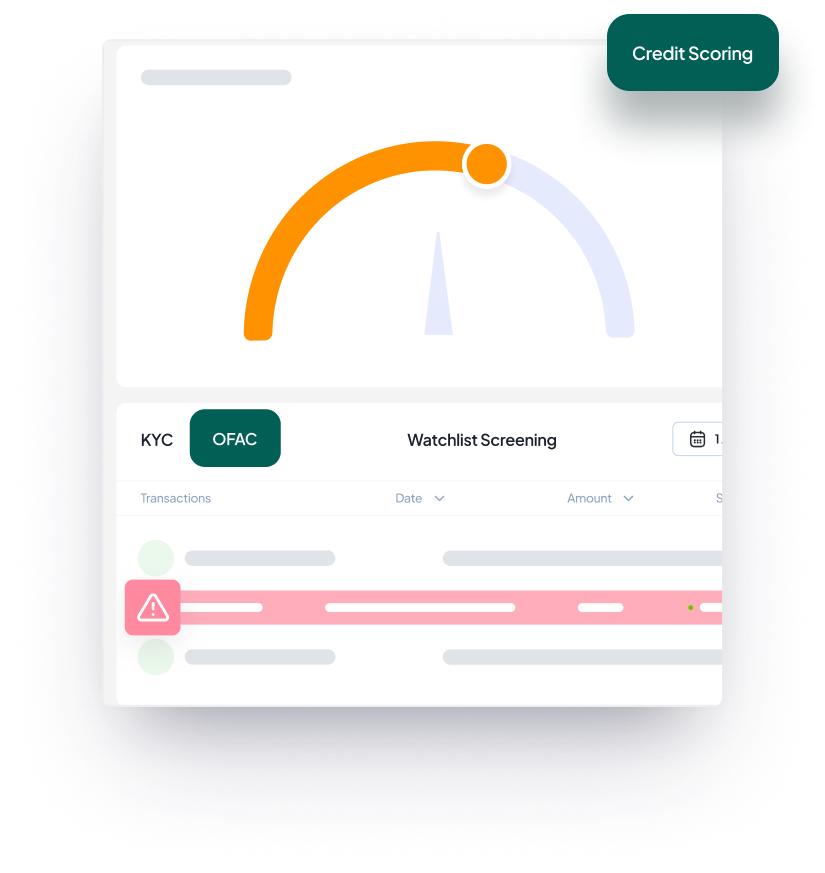

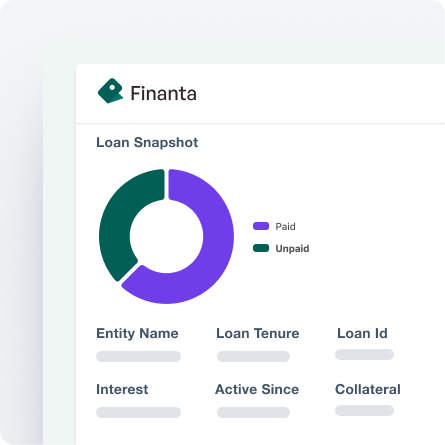

In the high-stakes world of commercial lending, regulatory compliance is not just a requirement—it's the cornerstone of trust and integrity. Finanta's Regulatory Compliance Check module is engineered to provide comprehensive risk management and compliance solutions that integrate seamlessly with third-party services for an in-depth credit and risk scoring, including KYC, OFAC, and document verification.

Transform Your Lending ProcessesEmploying a wide array of risk rating models, Finanta offers thorough risk assessments to accurately evaluate borrower creditworthiness and monitor portfolio risk.

With real-time monitoring and reporting, stay ahead of regulatory requirements with our automated AML and KYC checks.

Our module extends beyond individual compliance, encompassing KYB for comprehensive corporate due diligence, ensuring every aspect of your lending process adheres to the highest standards of compliance.

Advanced Risk Analysis

Advanced Risk Analysis

AML Compliant and

Full Risk Report

AML Compliant and

Full Risk Report

Company

Documentation and

Continuous Update

Company

Documentation and

Continuous Update

LEI and Tax ID

Verification

LEI and Tax ID

Verification

Detailed

Investigation and

Full Audit Trail

Detailed

Investigation and

Full Audit Trail

By integrating Finanta's Compliance Checks into your lending operations, you take control of regulatory risks and ensure compliance with ease and efficiency. Our platform is a critical ally in navigating the intricate compliance landscape of commercial lending, providing the tools you need to focus on growth and customer service.

In a world increasingly driven by technology, data, and digital marketing...

The development and application of advanced credit decisioning models are integral...