Transforming Lending with Finanta's Borrower Portal

Crafting seamless lending experiences that borrowers value. Discover the Finanta difference for a bespoke borrowing experience that sets you apart.

Crafting seamless lending experiences that borrowers value. Discover the Finanta difference for a bespoke borrowing experience that sets you apart.

Elevate your service with Finanta's Borrower Portal, where intuitive design meets functionality, offering real-time loan updates, automated alerts, secure document management, and covenant tracking—all in one place..

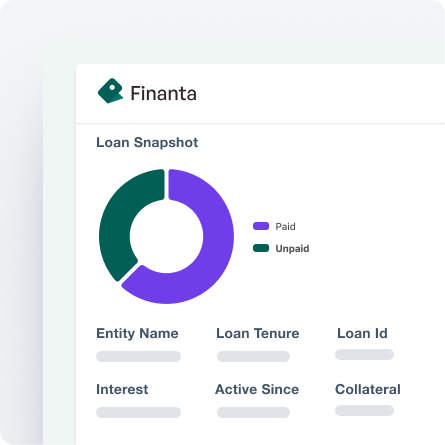

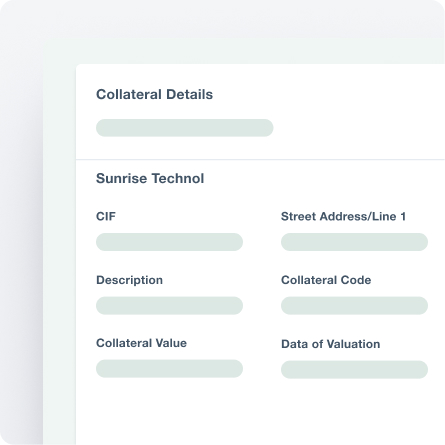

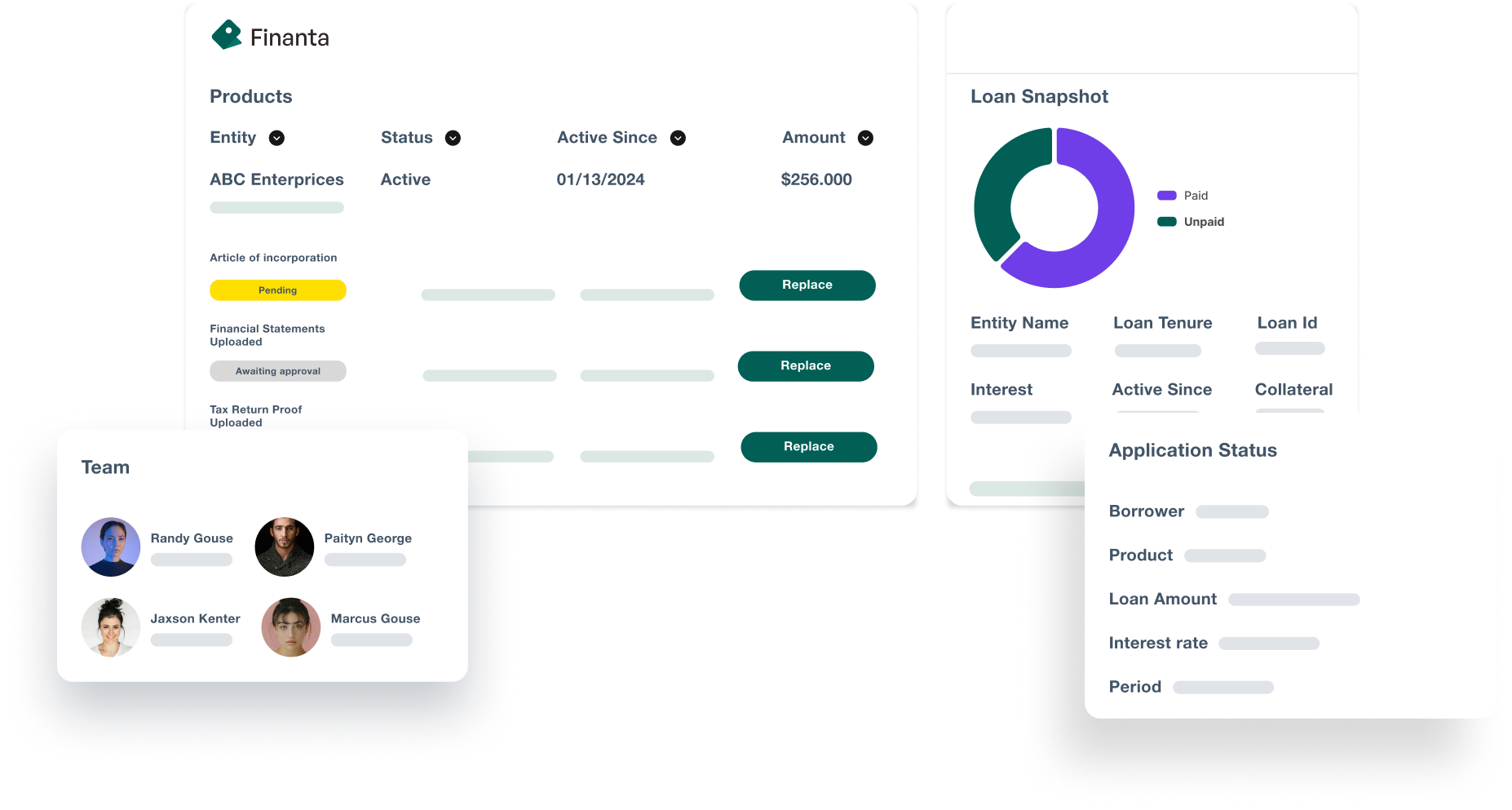

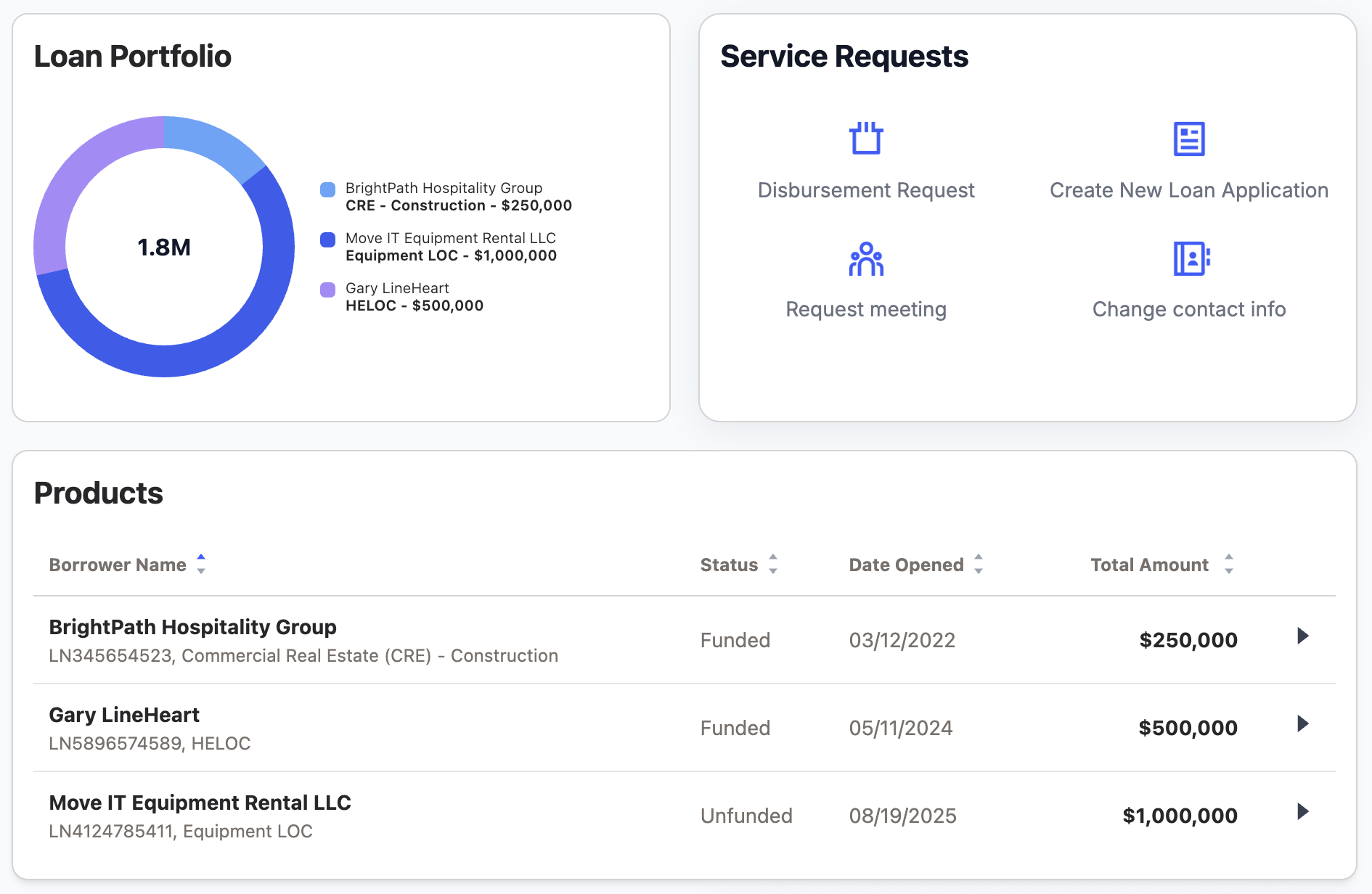

Comprehensive Portfolio View

Comprehensive Portfolio View

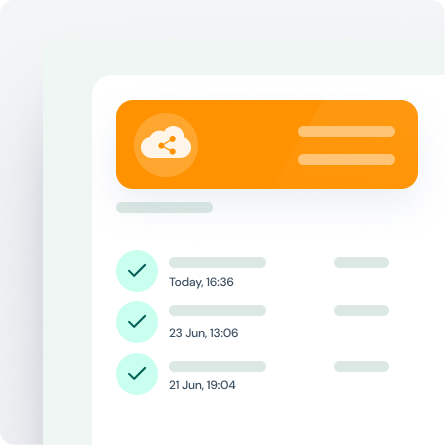

Real-Time Loan updates, Notifications & Covenant Tracking

Real-Time Loan updates, Notifications & Covenant Tracking

Documents Hub

Documents Hub

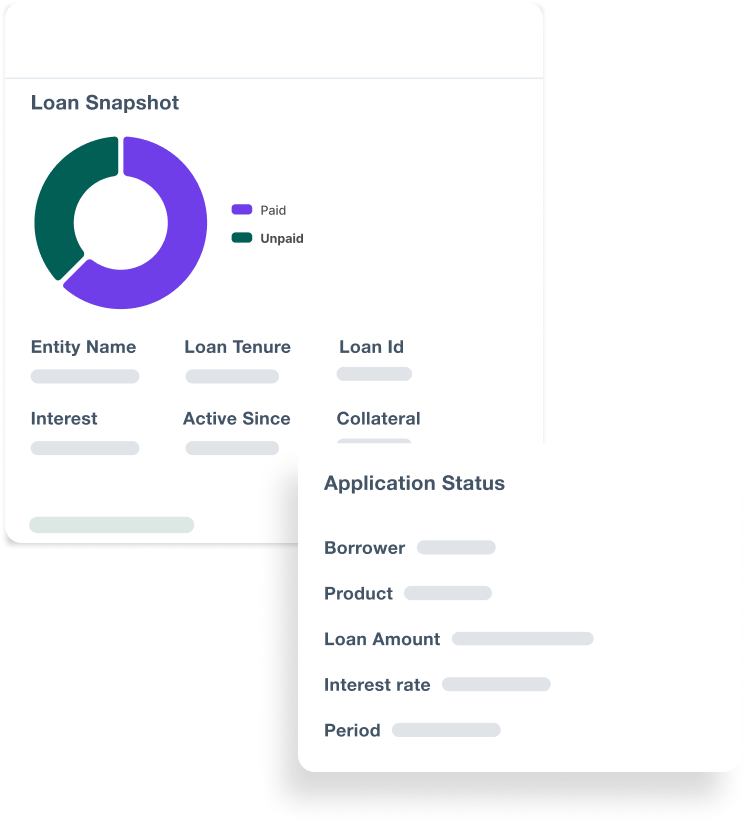

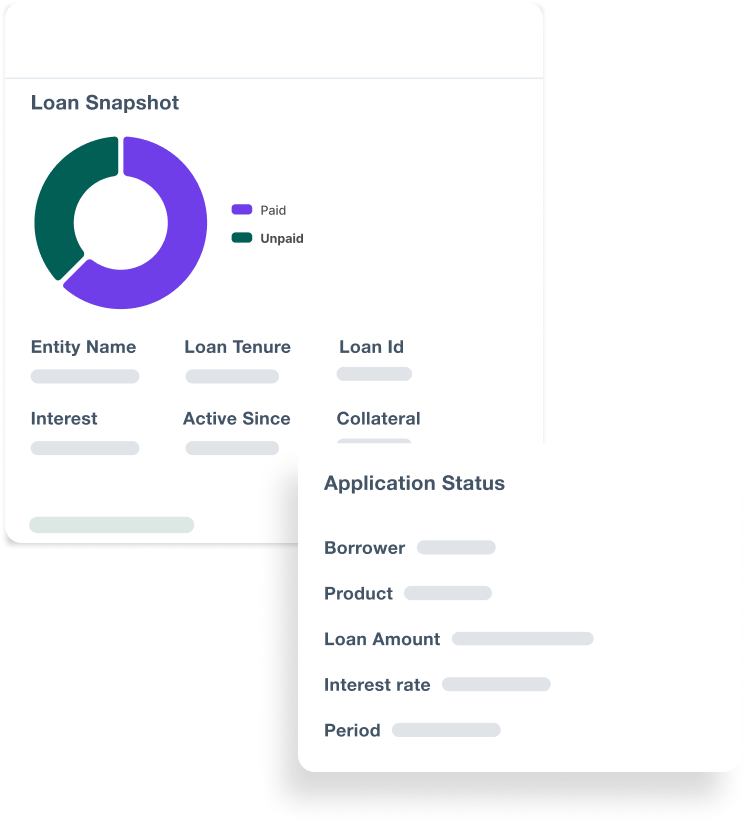

Role-based access and visualizations

Role-based access and visualizations

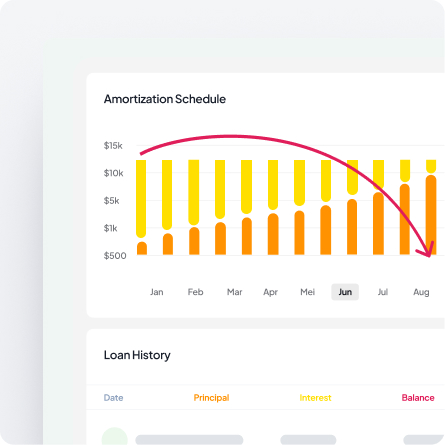

Payments Hub and Amortization Schedules

Payments Hub and Amortization Schedules

Embrace a lending solution that's designed not just for today but for the future. Finanta's Borrower Portal is built to adapt, ensuring lenders and borrowers are equipped for the changes tomorrow brings.