Commercial Lending

Excellence Redefined

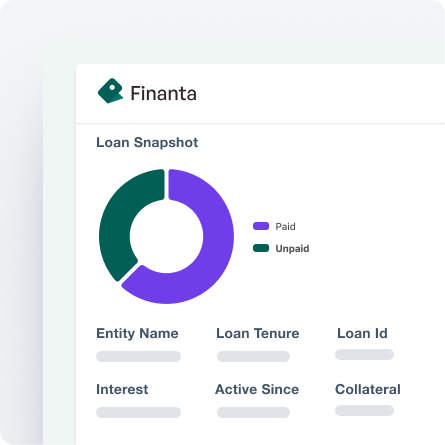

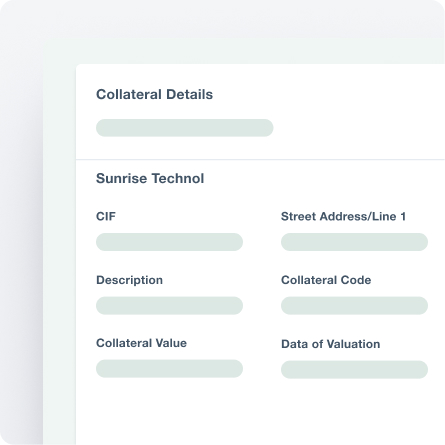

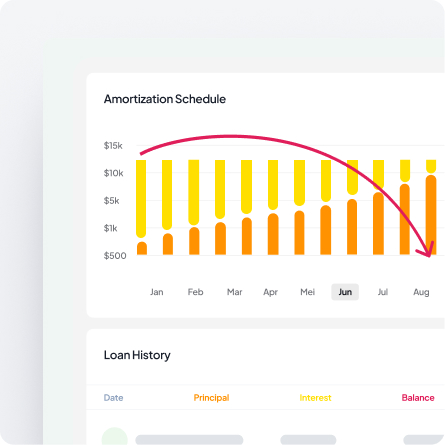

A modern commercial lending solution that delivers exceptional customer experiences with seamless digital integration, smart data aggregation, and automated risk scoring.