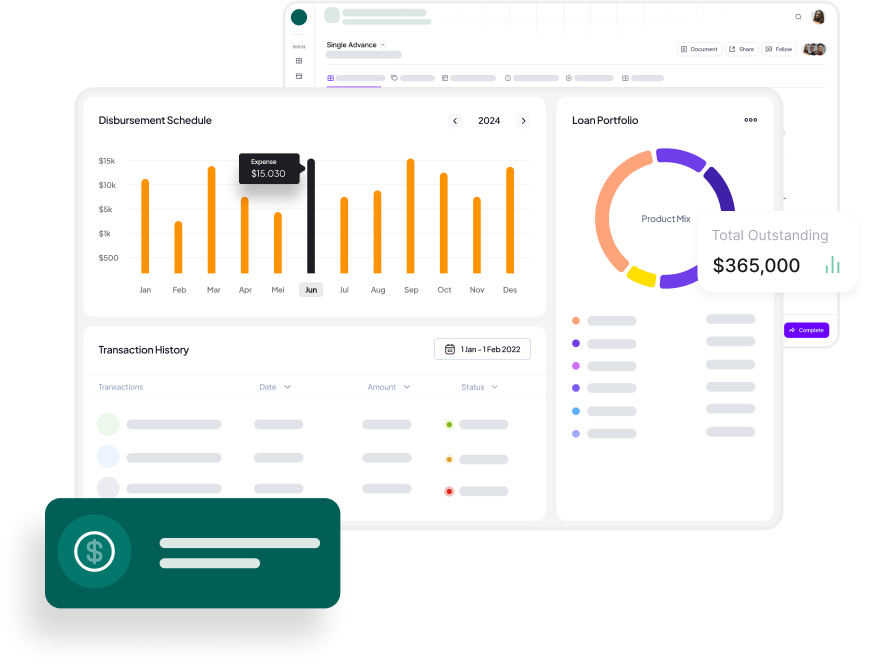

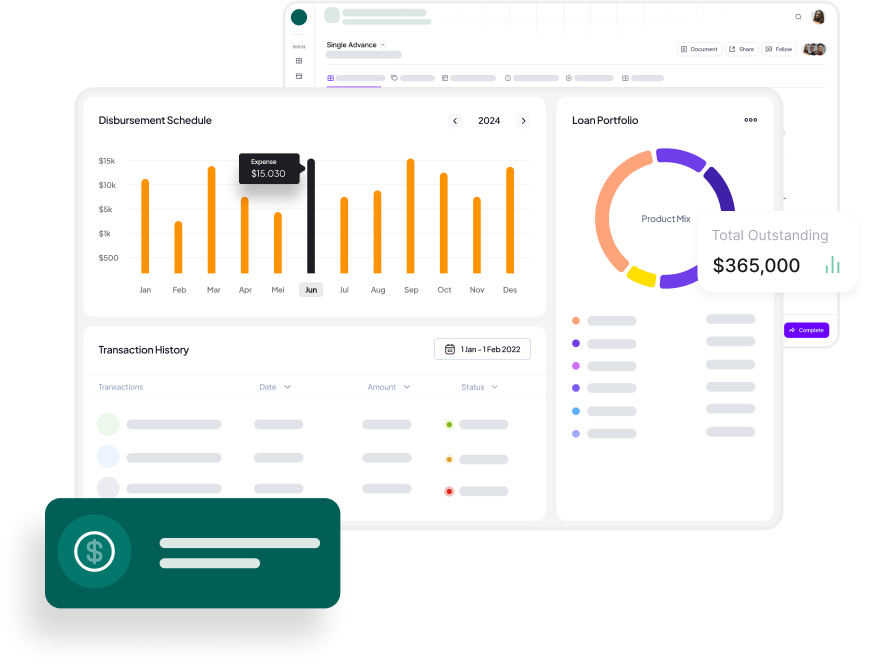

Industry Leading Commercial Lending Software Solution

Drive innovation and growth with Finanta's comprehensive lending solutions.

Drive innovation and growth with Finanta's comprehensive lending solutions.

Understand the potential impact of Finanta's commercial lending software on your business

Estimated efficiency gains from digitalized system

20%

Portfolio Growth in $

$0

Revenue from Portfolio Growth

$0

Total Cost for Year 1

$0

Return on Investment (ROI)

0%

$0

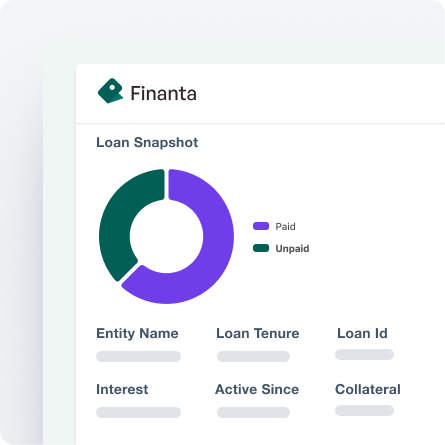

Finanta is committed to revolutionizing the commercial lending sector. Our robust suite of software solutions empowers lenders to navigate the complexities of the market, ensuring efficiency, compliance, and innovation at every stage of the lending process.

Finanta's commercial lending software is designed to address the critical challenges faced by lenders in the industry, providing comprehensive solutions that enable growth and innovation.

In the face of evolving regulations, Finanta provides a streamlined approach to regulatory compliance and reducing the risk of violations

Catering to lenders' infrastructure and security needs, Finanta ensures a cohesive lending experience, enabling smooth integration with fintech solutions

Finanta enables proactive risk mitigation and informed decision-making, helping lenders navigate the complexities of risk management in an increasingly competitive environment

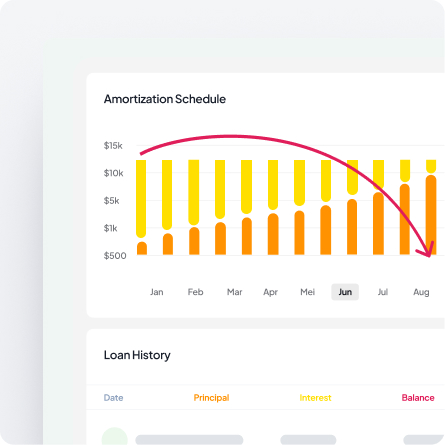

Addressing the challenge of operational efficiency, Finanta streamlines lending processes with digital workflows and automated loan segregation while also reducing manual errors

Finanta tackles the challenge of data-driven decision-making by providing lenders with reporting and analytics tools, and a customer-centric approach.

Finanta enhances operational efficiency for community and regional banks with digital workflows and tailored loan products. Streamline lending operations and ensure competitiveness with our seamless system integration

Finanta revolutionizes lending for credit unions with a member-centric approach and digital transformation support. Elevate member engagement and offer competitive financial solutions with our comprehensive SaaS platform

Finanta supports online and challenger banks with innovative solutions like digital loan origination and real-time analytics. Stay ahead in the digital age with our advanced lending solutions and regulatory agility

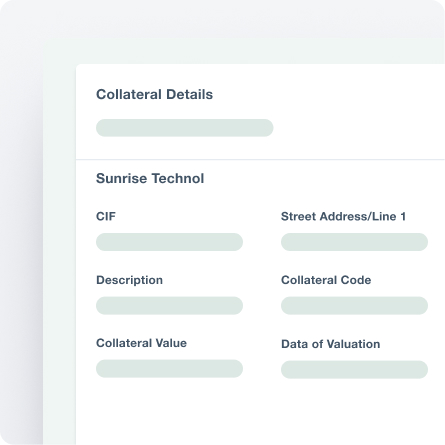

Finanta provides commercial real estate lenders with advanced underwriting tools and market analysis capabilities. Simplify the lending process and make informed decisions with our sophisticated analytics

Finanta empowers equipment leasing and financing companies with accurate asset valuation tools and robust portfolio management systems. Optimize operations and enable risk diversification with our comprehensive lending software

Finanta addresses the challenges of asset- backed lenders with seamless technological integration and regulatory compliance tools. Ensure compliance and mitigate risks with our solutions designed specifically for asset-backed lending