Revolutionizing Lending for Asset-Backed Lenders

Stay ahead in the competitive landscape with our innovative solutions.

Stay ahead in the competitive landscape with our innovative solutions.

The asset-backed lending ecosystem is diverse, encompassing lenders who provide financing secured by various types of assets such as equipment, invoices, etc. Finanta's solutions are designed to integrate seamlessly with this landscape, enhancing the capabilities of lending platforms and enabling tech companies alike.

Online and challenger banks face distinct challenges in commercial lending that Finanta can help solve.

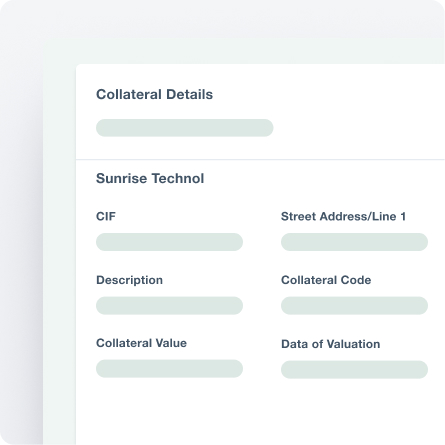

Asset Valuation

Asset Valuation

Portfolio Diversification

Portfolio Diversification

Funding and Liquidity

Funding and Liquidity

Regulatory Compliance

Regulatory Compliance

Technological Integration

Technological Integration

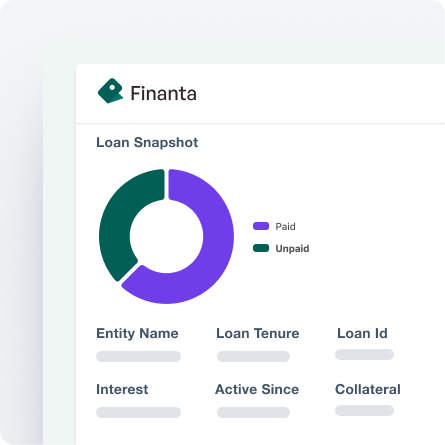

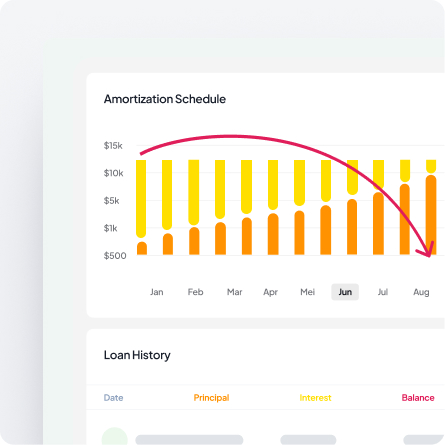

Our comprehensive suite of lending software is designed to empower new age financial institutions with cutting-edge tools for every aspect of commercial lending

Finanta’s cutting-edge commercial lending software is crafted to deliver a monumental shift in commercial lending operations of online and challenger banks. Our solution is designed to drive significant improvements across key metrics, ensuring your bank stays competitive and efficient in a rapidly evolving market

Make informed lending decisions with precise valuation of collateral assets.

Maintain financial stability with effective funding and liquidity management.

Achieve a balanced loan portfolio with managed risks and maximized returns.

Stay ahead of regulatory changes and reduce and compliance risks.

Streamline lending processes for faster and more secure transactions.